On Friday, August 6, the U.S. Department of Education issued a release about the upcoming negotiated rulemaking sessions for higher education, as well as details about the categories of negotiators who will comprise the first rulemaking panels of the Biden Administration.

Beginning in October, the negotiated rulemaking committee will meet virtually to rewrite regulations pertaining to Public Service Loan forgiveness, income-contingent repayment plans, and borrower defense to repayment, among other issues. The Department has focused this negotiated rulemaking session on issues primarily related to student loans, targeted discharge of loans and loan forgiveness authority. In addition to its focus on federal student loans, the negotiated rulemaking committee will also establish a subcommittee to establish regulations pertaining to Pell Grant eligibility for incarcerated individuals.

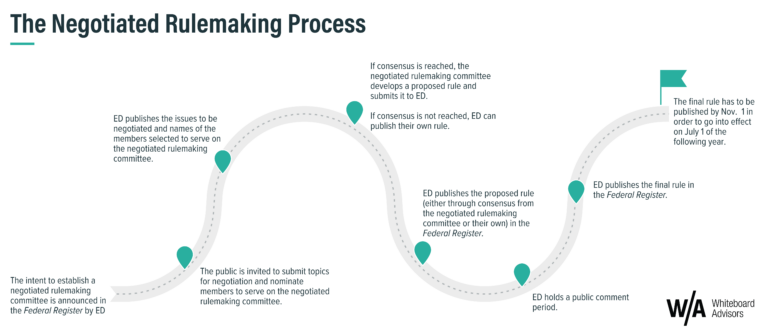

In May, the Biden Administration announced the first round of hearings to gain feedback and input from the higher education community about topics to be addressed through negotiated rulemaking, the process by which the legislative intent of the Higher Education Act (HEA) can be translated into action.

In its most recent announcement, the Department calls for nominations of negotiators in the following categories, with a note that negotiators who are individuals or from organizations that represent the perspective of historically underserved and/or low-income communities are of particular interest:

- Dependent students

- Independent students

- Student loan borrowers

- Legal assistance organizations that represent students and/or borrowers

- U.S. military service members, veterans, or groups representing them

- State attorneys general

- State higher education executive officers, state authorizing agencies, and/or state regulators of institutions of higher education and/or loan servicers

- Individuals with disabilities or groups representing them

- Financial aid administrators at postsecondary institutions

- Two-year public institutions of higher education

- Four-year public institutions of higher education

- Private nonprofit institutions of higher education

- Proprietary institutions

- Minority-serving institutions of higher education

- Federal Family Education Loan (FFEL) lenders and/or guaranty agencies

- Accrediting agencies

In a first-of-its-kind call for negotiators, the Department is also seeking two advisors to the committee and is interested in an employer whose employees are eligible for Public Service Loan forgiveness, and another individual with expertise in research and analysis of higher education data. These advisors are non-voting members and will provide technical assistance and expertise to the negotiating panel.

Nominations for a committee, subcommittee or advisor role must be submitted for 21 days following the notice in the Federal Register and can be submitted to negregnominations@ed.gov.

The first negotiating session will be held on October 4 – 6 with subsequent meetings on November 1 -5 and December 6 – 10. All meetings will be virtual and open to the public.

Our team has written frequently and advised on the topic of negotiated rulemaking including some of the issues under consideration by the Department of Education.