What is the forecast for K-12 spending after the stimulus funds expire? The answer is that, as is often the case, “it depends.” Let’s consider three categories of spending we’ve been monitoring in the order of blood-letting risk: staffing, tutoring, and literacy materials.

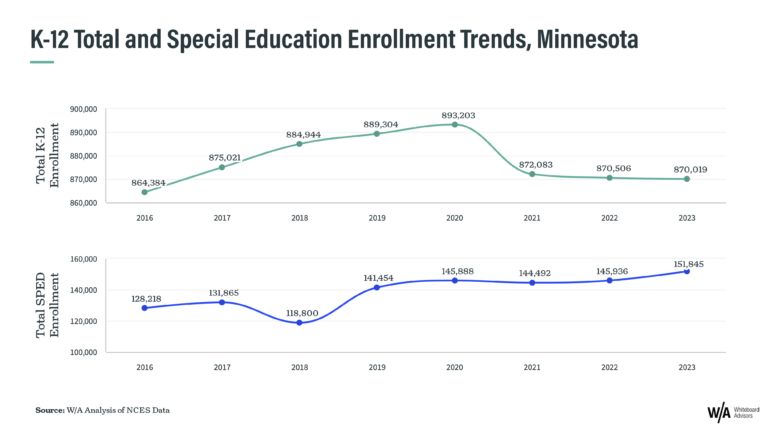

- School staffing is likely headed for the largest downward adjustment. The key reason is that people and positions occupy more than 80% of a district’s budget – and many are not teachers, which make up less than half of staff. This is the largest budget category and there is more room for meaningful budget adjustments such as position attrition, assignment changes, time reductions, and cuts. Typically, it starts at the administrative and outside contractor level and slowly, if at all, moves towards the classroom. Classroom activities and programs, especially those serving at-risk students and categorial priorities are usually the last to face cuts. Adding to forecast drama, many school districts have been adding positions throughout the pandemic while enrollment (which means future revenue) has been declining. Something has to give.

- Tutoring is headed for a downward adjustment, but that begs for clarification. During the pandemic state agencies invested about $4.4 billion in tutoring and local districts spent about $4.5 billion, or 2.8%, of their ESSER II and III funds on tutoring. Note that the spending runs from 2020 through 2024, so that’s about a $1.2 billion annual increase or a 24% increase over the $5 billion pre-pandemic estimate for the K-12 tutoring market. That 24% bump is clearly unsustainable – but hold on, there are market tailwinds suggesting that the post-pandemic-normal will be better than pre-pandemic-levels. Without going into details, these include historic learning loss demanding effective remediation for millions of students running out of time to catch up. It’s a seriously big challenge that cannot be fixed without some form of high-quality “tutoring,” which is in quotes because the practice is evolving into submarkets like chat base, family engagement, online, in-person, etc.

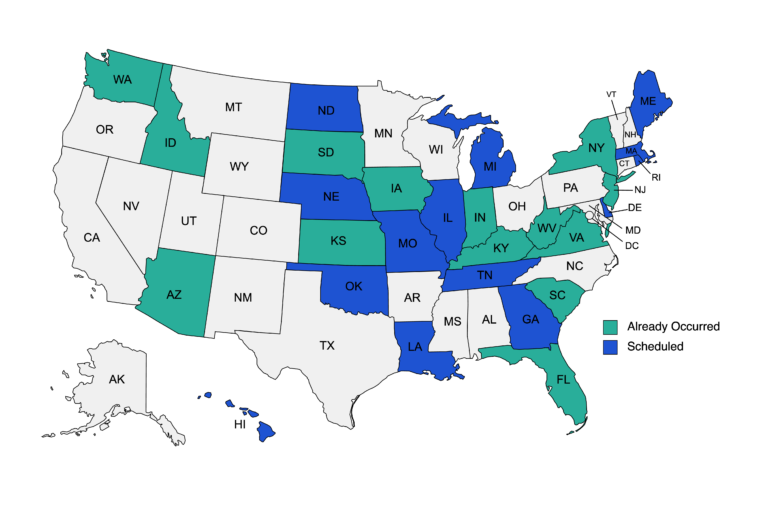

- The English Language Arts (ELA) market is likely to not experience an overall downward adjustment and likely in a strong post-pandemic position. The stimulus funds gave districts about a 21% bump in instructional material purchasing power. Not all of that increase went to curriculum, and a smaller share went to ELA. Districts probably allocated a few extra hundred per-pupil for ELA and, while that is going away, other state and local funds for literacy are likely to step-in. From 2020 to 2024, 28 states passed a “Science of Reading” law requiring changes to teacher training, instructional practice, and literacy materials. The new requirements are driving investment which will likely exceed the federal stimulus contribution. What’s more, these laws are still relatively new (change comes slowly in K12) and the issues (early literacy) will remain a priority for the foreseeable future.

These are just three of the issues we’ve been tracking. Forecasting the impact of the expiring stimulus funds requires category specific analysis. Think of it like the win-loss probability chart of a football game. There’s always a chance that the forecast is wrong, but the charts do depict probable outcomes. (I just wish the Bills didn’t defy their likely good fortune so often). Other sectors like mathematics, social studies, and STEM have their own unique narratives and forecast charts, and we are watching those as well.

If you have any questions, comments, or contrary views, we would love to hear them. Your ideas and viewpoints are why we get excited about our work every day.