On June 30, the U.S. Supreme Court upended the Biden Administration’s campaign promise to forgive student debt. As soon as the Court released its decision, President Biden announced the Administration’s plan to “provide student debt relief to as many borrowers as possible, as quickly as possible.”

In his remarks, the President offered three ways in which the Administration would seek to provide loan relief to borrowers. One of the three approaches the President suggested would “allow [Education] Secretary Cardona…to compromise, waive, or release loans under certain circumstances…” by leveraging a public policy process called “negotiated rulemaking.”

Almost overnight, an obscure federal rulemaking process leapt from the world of wonkery, and into the mainstream.

In Forbes, W/A’s Alison Griffin explains what exactly negotiated rulemaking is and what lies ahead.

Alison also spoke with USA Today about the negotiated rulemaking process and what to expect.

Discussion with Dr. Robert Kelchen and Dr. Rebecca Natow

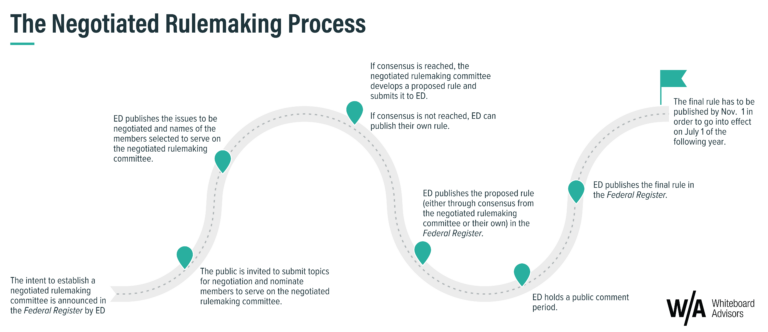

Following the Supreme Court’s ruling on debt forgiveness, the Biden administration will use the federal negotiated rulemaking process to advance reforms to the federal student loan program, most notably to seek debt forgiveness for millions of borrowers. But, what is negotiated rulemaking? Whiteboard Advisors’ Senior Vice President, Alison Griffin sat down with esteemed higher education faculty members Dr. Robert Kelchen and Dr. Rebecca Natow to seek clarity on the negotiated rulemaking process, discuss how the public can get involved, and understand what the future may hold for student debt forgiveness.

Dr. Robert Kelchen is a Professor and Head of the Department of Educational Leadership and Policy Studies at the University of Tennessee, Knoxville. Dr. Rebecca Natow is an Assistant Professor of Educational Leadership and Policy and the Director of the Higher Education Leadership and Policy Studies Program at Hofstra University.